California Public Banking Act (AB 857)

On October 2, 2019, Governor Gavin Newsom signed the California Public Banking Act (AB 857) into law. Passed by the California Legislature on September 13, 2019, the bill allows cities, counties, and joint powers authorities to establish public banks. This landmark law gives local governments the ability to keep taxpayer dollars working in their communities instead of generating profits for Wall Street shareholders. AB 857 was the first law in the nation to allow cities and municipalities to create public banks, and the regulations for the law were finalized by state regulators in 2022.

How Public Banks Serve Communities

Public banks, unlike privately owned Wall Street banks that prioritize shareholder profits, use their deposits to make loans that directly serve local needs. These institutions can fund affordable housing, support small businesses, finance public infrastructure projects, and assist with post-disaster rebuilding. These investments strengthen communities and demonstrate fiscal responsibility.

The Public Banking Act requires public banks to obtain a banking charter from the California Department of Financial Protection and Innovation (DFPI) and meet the same financial and regulatory standards as commercial banks. They are also subject to transparency laws such as the Brown Act and Public Records Act, ensuring good governance and a clear commitment to serving the public interest.

How the Banks Will Be Formed

The California Public Banking Act requires cities and counties to develop a business plan, present it to the public, and gain approval from their local legislative body. Public banks will be structured as nonprofit public benefit or mutual benefit corporations, owned by cities and counties, and overseen by independent boards of directors and professional bankers. In response to the Orange County bankruptcy of the mid-1990s, California strengthened collateral requirements for local agency deposits; AB 857 extends these same protections to public bank deposits.

The law will launch as a pilot program, allowing a maximum of two licenses per year and no more than ten licenses over seven years. Once the pilot ends, the Department of Financial Protection and Innovation (DFPI) will evaluate the program’s effectiveness. The goal is to demonstrate the benefits of public banks for California communities and local governments. If the pilot proves successful, the law may be expanded to allow public banks statewide.

Public banks are required to partner with local community banks, credit unions, and CDFIs to provide retail services in their areas. This strengthens local financial institutions and increases lending that supports the local economy. Like credit unions, public banks will be tax-exempt and, as public entities, must follow the Brown Act and Public Records Act to ensure transparency in their operations and decision-making.

In January 2022, the DFPI finalized the regulations for AB 857. With this framework in place, advocates are now working with local governments to establish city- and region-owned public banks designed to meet their communities’ needs.

How Transparency and Safety Will Be Assured

Public banks will have oversight at multiple levels to ensure transparency, accountability, and sound operations:

- An independent board of directors will oversee the bank’s management and operations.

- The city or county that owns the bank will ensure it aligns with their strategic goals and community priorities.

- The DFPI will monitor compliance with state laws and regulations and ensure the bank operates safely and responsibly.

- The Federal Deposit Insurance Corporation (FDIC) will provide deposit insurance and enforce federal banking laws and regulations.

Community Support

The California Public Banking Act was introduced to the State Legislature by lead authors Assemblymember David Chiu (D-SF) and Assemblymember Miguel Santiago (D-LA). The bill was led by the California Public Banking Alliance and backed by over 100 organizations representing 3.3 million members in California including the California Labor Federation, AFL-CIO, SEIU California, California Democratic Party, California Nurses Association (CNA), National Nurses United (NNU), American Postal Workers Union, UFCW Western States Council, AFSCME California, American Federation of Teachers CFT/AFT Local 1931 and Local 2121, Our Revolution, Fossil Free California, Courage Campaign, Los Angeles County Democratic Party, Green Party of California, United Educators of San Francisco, Healthcare for All – California.

Read the bill text and related resources:

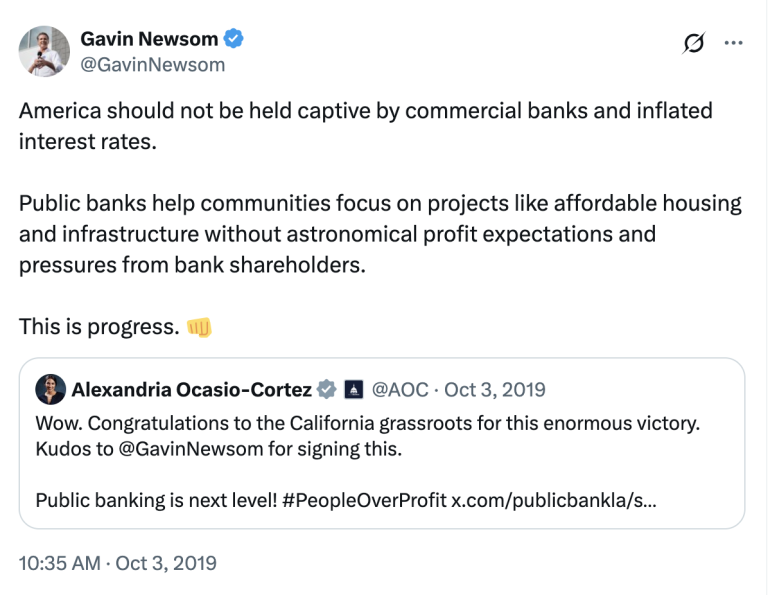

Governor Gavin Newsom tweets his support for the California Public Banking Act, quote tweeting AOC: “America should not be held captive by commercial banks and inflated interest rates. Public banks help communities focus on projects like affordable housing and infrastructure without astronomical profit expectations and pressures

Representative Alexandria Ocasio-Cortez quote tweets Public Bank Los Angeles, congratulating our grassroots-led victory in passing the historic California Public Banking Act: “Wow. Congratulations to the California grassroots for this enormous victory. Kudos @GavinNewsom for signing this. Public banking is next level. #PeopleOverProfit.”

Senator Bernie Sanders quote tweets the California Public Banking Alliance after the California Public Banking Act passes through six legislative committees and the Assembly floor: “It makes a lot more sense to me for cities and states to establish banks that invest in local communities instead of handing over taxpayer dollars to Wall Street banks whose business model is fraud.”