Join Us for the CalAccount Hearings on July 18th in Sacramento & Los Angeles + Endorse CalAccount!

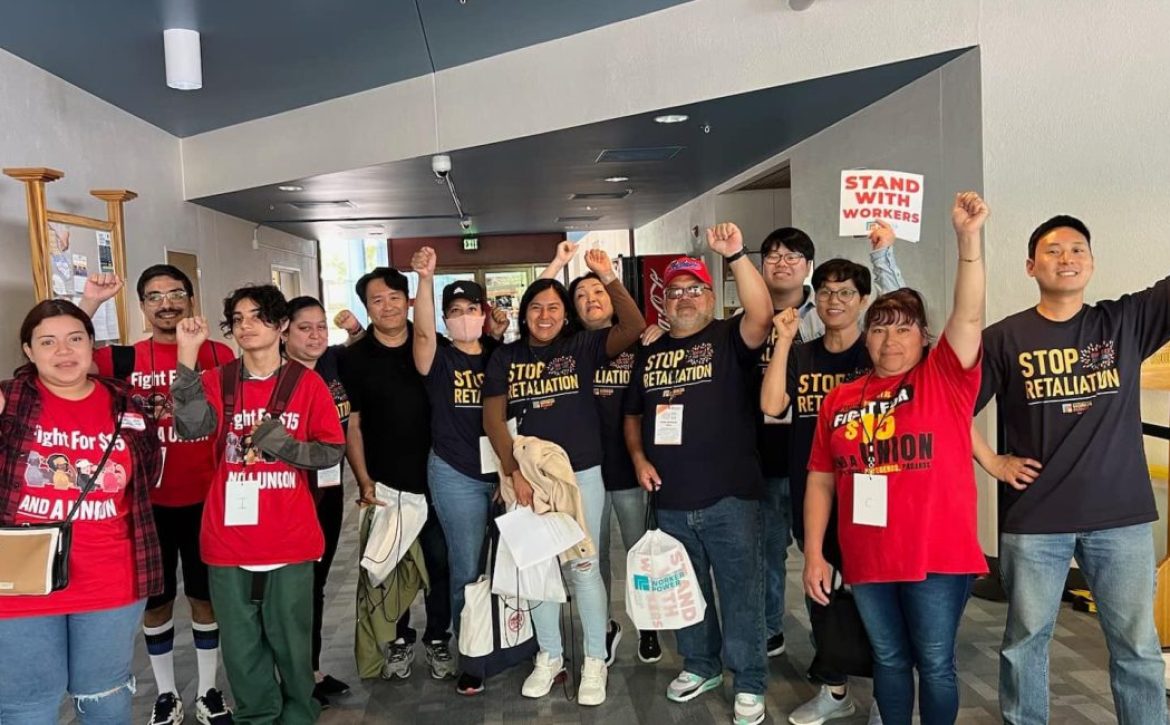

Over the past year, the CalAccount Community Coalition has tirelessly advocated through reports, testimony, and public input, stressing the urgency of providing fee-free checking accounts with debit card access to all Californians. Working families, especially those facing financial hardship, shouldn’t have to pay overdraft fees and other predatory penalties to access their own money!

Over the past year, the CalAccount Community Coalition has tirelessly advocated through reports, testimony, and public input, stressing the urgency of providing fee-free checking accounts with debit card access to all Californians. Working families, especially those facing financial hardship, shouldn’t have to pay overdraft fees and other predatory penalties to access their own money!

On July 1st, RAND released the CalAccount Market Study & Feasibility Assessment, commissioned by the State Treasurer’s Office, stating that CalAccount is feasible and necessary to address financial inclusion and the needs of unbanked and underbanked populations in California. This gives us the green light to introduce legislation next year for legislative approval of the program, making CalAccount the nation’s first state-administered universal banking program.

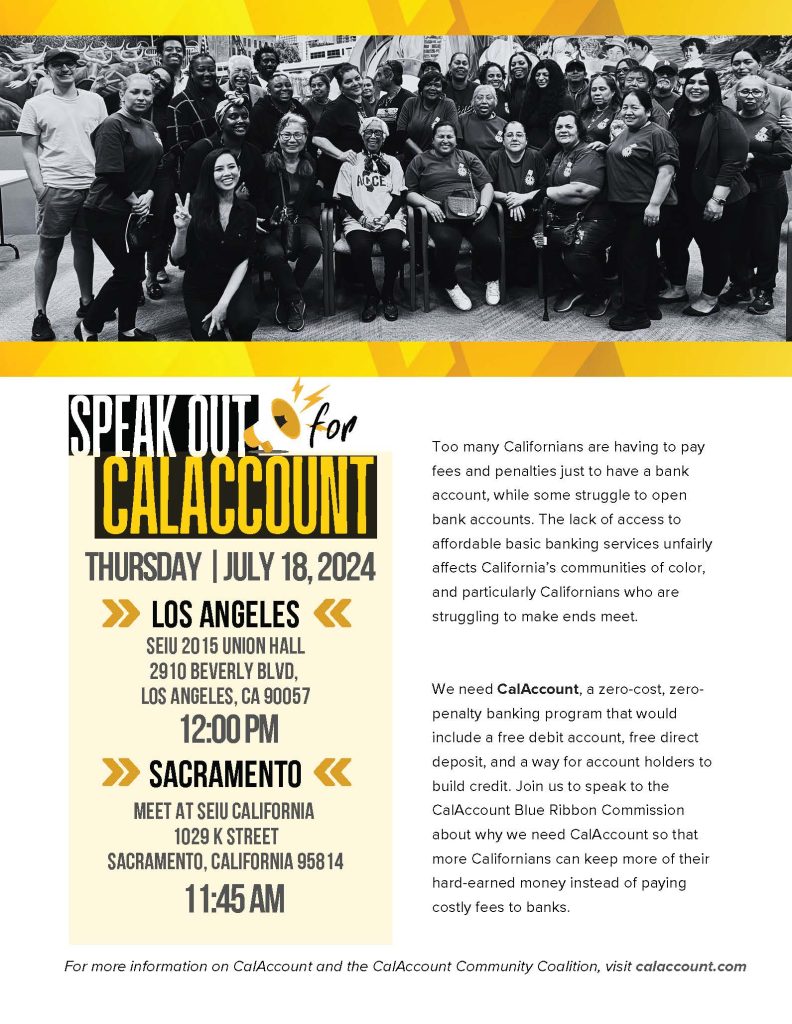

JOIN US ON JULY 18th: We’re coordinating public support for CalAccount in Sacramento and Los Angeles. The Sacramento hearing will be held at the State Treasurer’s Office. Supporters will meet at SEIU State Council‘s office in Sacramento at 12pm on July 18th for a brief training session and lunch. They will then walk (about 3 blocks) to the State Treasurer’s office where the commission hearing will be held.

In Los Angeles, we will be convening on July 18th at 12pm at SEIU 2015 Union Hall and will call in to participate remotely for public comments.

Sacramento – July 18th – View/Download the Sacramento Flyer

12pm – SEIU State Council – 1029 K Street, Sacramento, CA 95814

1pm – Commission Hearing at State Treasurer’s Office – 901 P Street, Conference Rm 102, Sacramento, CA 95818

Los Angeles – July 18th – View/Download the LA Flyer

12pm – SEIU 2015 Union Hall – 2910 Beverly Blvd, Los Angeles, CA 90057

1pm – Remote call-in for public comment.

Reach out to us at info@capublicbanking.com and let us know if you will be able to join us in either Sacramento or LA.

CalAccount Talking Points

The CalAccount Market Study & Feasibility Assessment report finds:

CalAccount is needed: No-fee-/no-minimum balance accounts are “rare in California,” and underbanked Californians pay hundreds of dollars a year in fees to use their money. 95 percent of banks charge overdraft fees; monthly service fees are common, and unbanked Californians face check-cashing and money order fees among others. CalAccount will enable savings on those multiple fees with “meaningful impacts” on California households.

CalAccount “could significantly reduce disparities in access to banking” for Black and Latina/Latino and low-income Californians. CalAccount could cut those disparities by 25% to 30% — or more under some scenarios — the report finds.

CalAccount is feasible. The account’s technical features are “similar or identical to transaction account features already being offered” by banks and fintechs. Nearly four in 10 unbanked Californians – and three-fourths of underbanked Californians – are already using mobile online financial services similar to those CalAccount would offer.

CalAccount’s benefits outweigh the costs for all versions of the program the report analyzes, with an estimate of $31 million more in benefits than costs for a mobile/online-only version of the program.

The report suggests ways to set up a successful CalAccount program. For example, the report notes that CalAccount could help banks acquire customers for their other services as well as generate fees and revenues for banks and that outreach by community organizations could ensure CalAccount signs up enough customers to make money. In fact, the report finds that banks and fintechs are already offering no-fee/no-penalty accounts – underscoring that the issue is not whether such accounts are financially viable but whether the state guarantees financial access that is not subject to the whims of bank executives.

HR&A Advisors’ recent report on CalAccount offers insights that complement the RAND report. Those include estimates that CalAccount will save Californians an aggregated $3.1 billion annually and an impact analysis estimating that the program will generate a total of $5 billion in activity in the state’s economy.

Endorse CalAccount!

Join over 250 organizations in supporting CalAccount to provide free financial services for all Californians. By endorsing CalAccount, your organization will help support financial inclusion, reduce the unbanked population, and ensure that all residents have access to essential banking services without the excessive fees, fines, penalties, and barriers posed by Wall Street banks and commercial financial institutions.

Endorse CalAccount today by signing our organizational support letter. Join the movement and stand with our growing list of supporters by viewing the links below.

If you have already endorsed, please reaffirm your commitment by signing our 2024 endorsers letter.