A Technical Guide by CA Public Banking Alliance

Welcome to the June edition of the CA Public Banking Alliance (CPBA) Newsletter! We’re excited to share insights into the transformative power of public banking in California and beyond. Explore our technical brief, learn about our initiatives to ensure financial inclusion through CalAccount, and find out how you can support the ongoing banking revolution. Plus, we celebrate a historic milestone in Public Bank East Bay’s public banking progress!

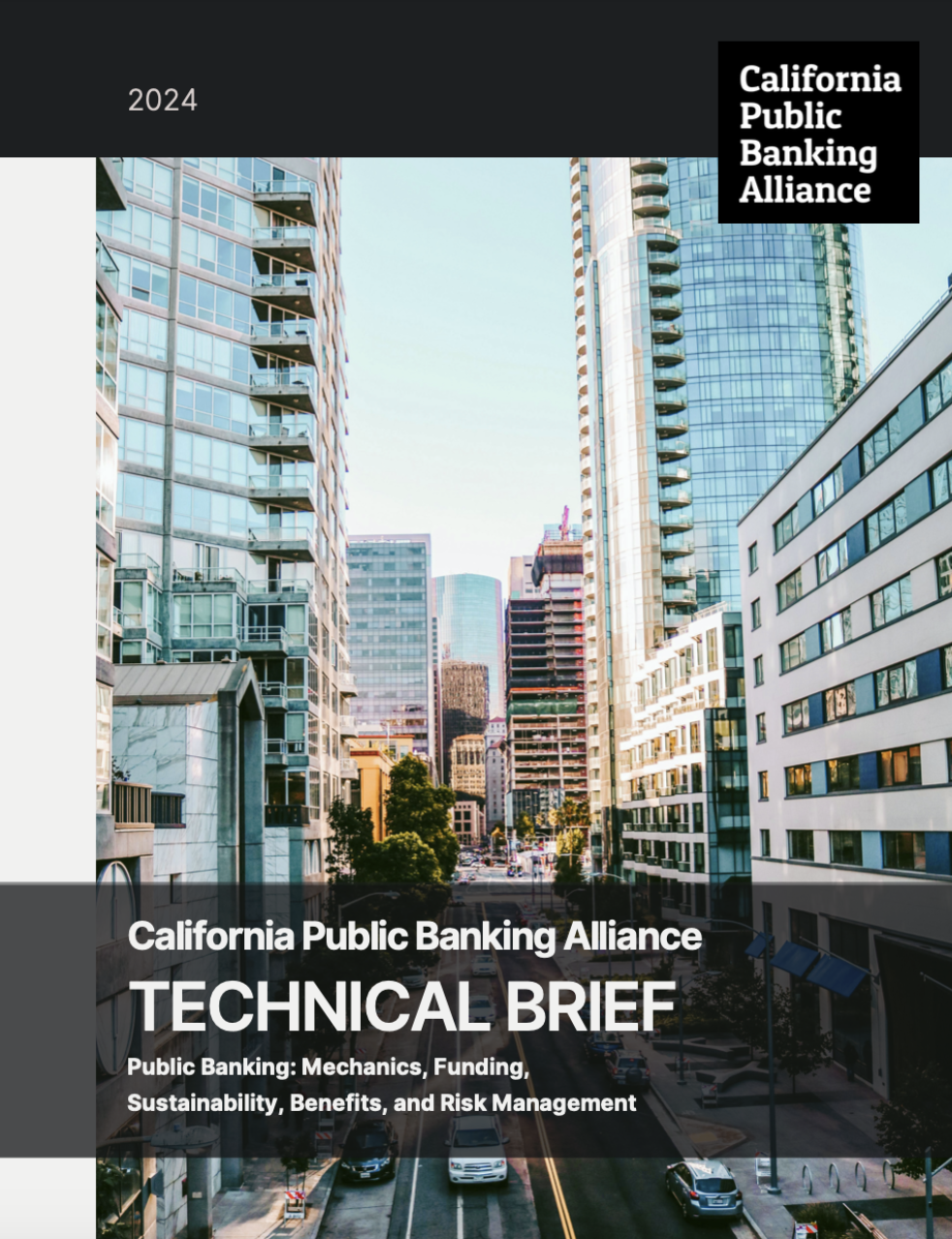

CA Public Banking Alliance Technical Brief: Exploring the Mechanics and Benefits of Public Banks

Discover the transformative potential of public banking with the CA Public Banking Alliance Technical Brief. Our newly designed comprehensive guide covers essential topics, including:

- Mechanics of a Public Bank: Understand how public banks operate and their fundamental principles.

- Start-Up Capital and Lending Funds: Learn about various methods to acquire the necessary capital and funds for lending.

- Sustainability: Explore strategies to ensure the long-term viability of a public bank.

- Advantages of Public Banks: Discover the numerous benefits, from fostering local economic growth to supporting community projects.

- Examples of Public Banks: Examine successful public banks in the US, and around the world, and their impact.

- Financial Components: Gain insights into the financial structures that underpin public banking.

- Risk Management: Identify the risks involved for both the public and the sponsoring entity and learn effective risk mitigation strategies.

- Rate of Return: Get projections on the expected return on initial capital investments.

- Municipal Finance Corporations: Learn about these entities and their role in public banking.

- Green Banks: Understand the concept of green banks and their importance in driving sustainable projects.

For a deeper dive into these topics and more, read our updated technical brief.

Historic Resolution for East Bay Public Bank Charter Passed

On May 29, 2024, Richmond, CA’s City Council unanimously passed a resolution authorizing East Bay Public Bank organizers to apply to state and federal regulators for a bank charter. This is the first such government resolution in the U.S. in 100 years! Congratulations, Richmond!

Save the Date! CalAccount Town Halls in Los Angeles and Sacramento on July 18th!

Earlier this year, we held a series of statewide town halls attended by hundreds of people in coordination with the State Treasurer’s Office to uplift the voices of those affected by Wall Street’s harmful and unfair banking practices.

On July 18, 2024, in preparation for the release of the final CalAccount market analysis report, we’ll be convening our second town hall in Los Angeles and Sacramento. Your voice matters in bringing free banking to California. Stay tuned for details!

CalAccount was featured in La Opinión, the US’s largest Spanish-language paper. Read the coverage: Revolución bancaria en favor de los más vulnerables (Banking revolution for the most vulnerable; see English translation).

Endorse CalAccount: Empower Californians with Free Financial Services

Join over 250 organizations in supporting CalAccount, a groundbreaking initiative to provide free financial services for all Californians. Over 30 percent of Black and Latina/Latino households are unbanked or underbanked. By endorsing CalAccount, your organization will help support financial inclusion, reduce the unbanked population, and ensure that all residents have access to essential banking services without the excessive fees, fines, penalties, and barriers posed by Wall Street banks and commercial financial institutions.

Endorse CalAccount today by signing our organizational support letter. If you have already endorsed, please reaffirm your commitment by signing our 2024 endorsers letter.

Join the movement and stand with our growing list of supporters by viewing the links below.

Sign On to Endorse CalAccount and our 2024 Endorsers Letter

View the Endorsers List

Support the Banking Revolution: Donate Today!

In 2019, the California Public Banking Alliance (CPBA) achieved a historic milestone with the passage of the California Public Banking Act (AB 857). Building on this success, our all-volunteer team and dedicated allies championed the California Public Banking Option Act (AB 1177) in 2021, which will make universal free banking services a reality.

Now, we’re focused on turning these groundbreaking legislations into tangible change. Our team is working tirelessly to establish local public banks across California and guide the CalAccount program to fruition.

Every dollar you donate is tax-deductible and directly supports our mission to open public bank doors and provide free banking services to all Californians. Your generosity will make a real difference in the lives of California communities.

Thank you for your support.

Donate Now

CPBA Advocacy Team: Julian LaRosa, Lovoy Mejia, Trinity Tran, Debbie Notkin, Sylvia Chi, Rick Girling, Goli Sahba, Brett Garrett, Doug MacPherson.

CPBA Advocacy Team: Julian LaRosa, Lovoy Mejia, Trinity Tran, Debbie Notkin, Sylvia Chi, Rick Girling, Goli Sahba, Brett Garrett, Doug MacPherson. California Public Banking Alliance at the NCRC Conference with Rise Economy.

California Public Banking Alliance at the NCRC Conference with Rise Economy. Oakland CalAccount Town Hall

Oakland CalAccount Town Hall Los Angeles CalAccount Town Hall

Los Angeles CalAccount Town Hall