CPBA December 2025 Newsletter: CA Power + National Momentum!

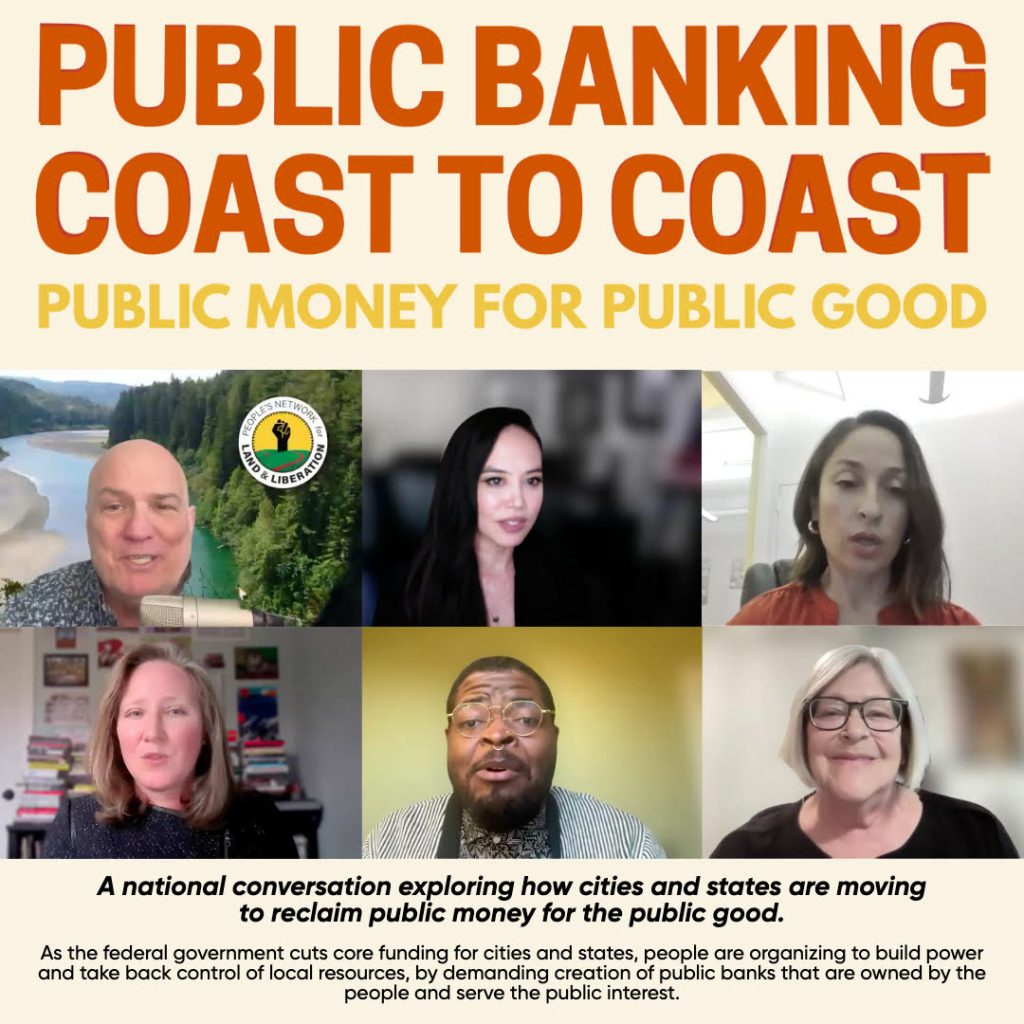

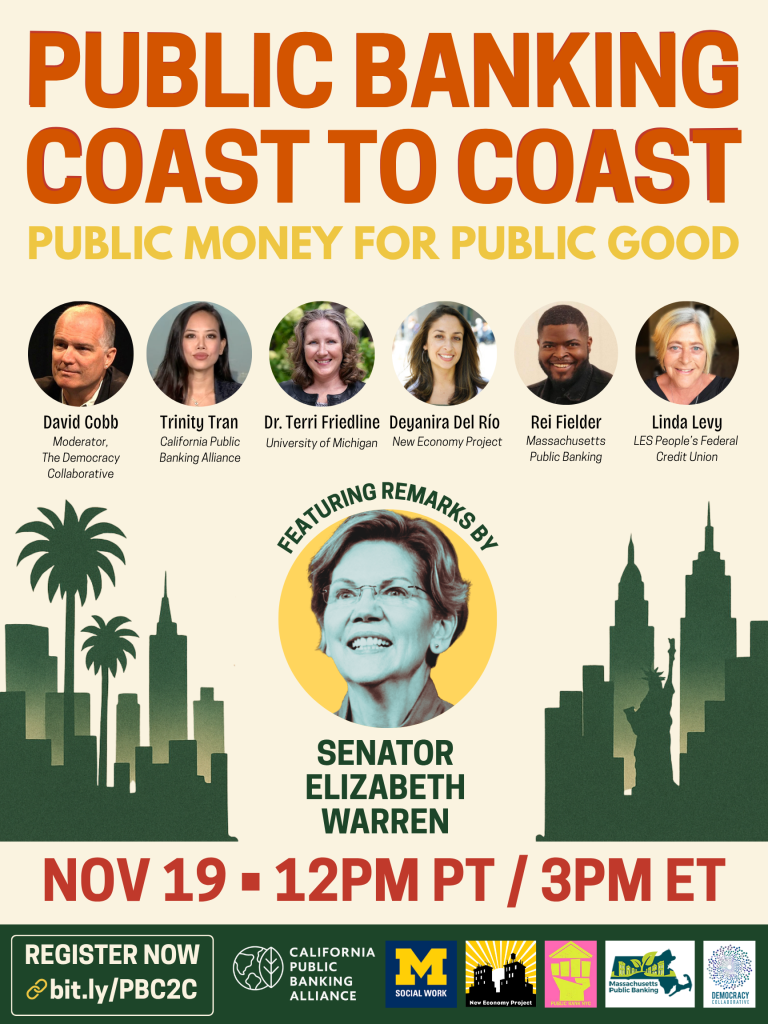

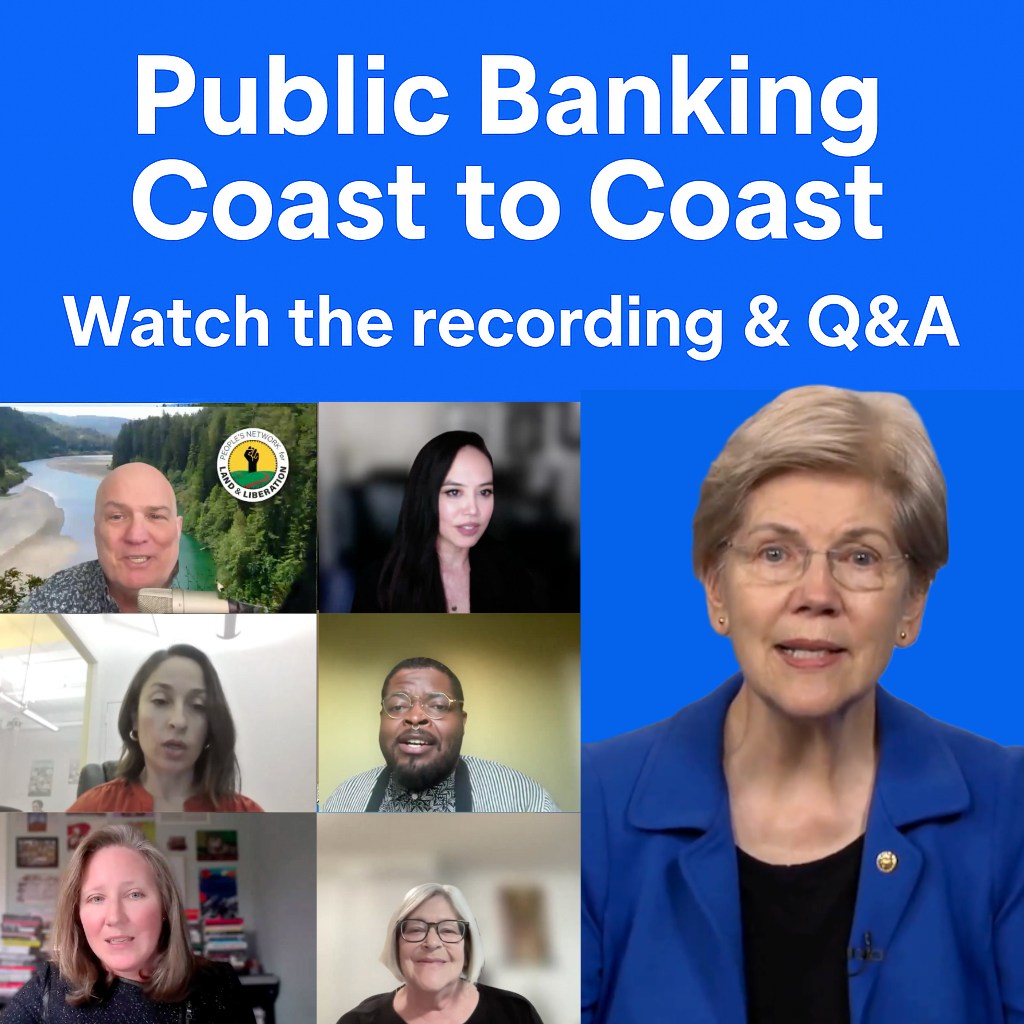

Public Banking Webinar with Senator Elizabeth Warren + Movement Leaders

California Public Banking Alliance co-hosted Public Banking Coast to Coast with opening remarks from Senator Elizabeth Warren! People from 39 states and several countries tuned in for a grounded conversation on how public banks can lower costs, keep dollars local, and invest in housing, small businesses, climate resilience, and community wealth.

Senator Warren set the tone clearly by reminding everyone that in a volatile federal moment, public money should serve the public.

We received an incredibly strong response of more than 130 pre-submitted and live questions from organizers, advocates, and public agencies, which says a lot about the level of curiosity and commitment to moving public banking from idea to implementation.

We’ve shared the materials below so people can keep studying them, sharing them, and putting them to work.

- Webinar recording: See the full session here and Senator Warren’s message here.

- Q&A: Link

- Resources from the event: Link

Thanks to our powerful speakers Trinity Tran, Dey Del Rio, Rei Fielder, Terri Friedline, and Linda Levy, and to our moderator, David Cobb.

And event co-hosts: New Economy Project, the University of Michigan School of Social Work, Massachusetts Public Banking, and The Democracy Collaborative.

There’s much more ahead for the public banking movement, and the momentum is now building across the country.

Harvard Law Public Banking Summit

California Public Banking Alliance is still energized from the Harvard Law School public banking summit “Conference on Public Banking for Community Development,” which brought together organizers, practitioners, and policy leaders shaping the future of public finance. CPBA Executive Director Trinity Tran and Legislative Director Sylvia Chi spoke on panels about California’s experience building the Alliance, from on-the-ground organizing to policy design and financial models.

Don Morgan, CEO of the Bank of North Dakota, shared insights of what more than a century of public banking can achieve. Stay tuned for the keynote recording!

We look forward to continuing building with Massachusetts Public Banking and community members, CDFIs, credit unions, and community banks across the country.

Regional News

LOS ANGELES

Los Angeles – Spectrum News – Momentum grows as LA moves to create public bank. As LA City Councilmember Hugo Soto-Martinez puts it, “Our taxpayer dollars are paying for these projects and at the same time, saving hundreds of millions of dollars that we currently pay in interest to Wall Street banks.”

The LA County Democratic Party representing over 3 million registered Democrats endorses the LA Public Bank! In its newly passed resolution, LACDP backs a nonprofit, city-owned, tax-exempt public bank that can manage the City’s funds, work with local lenders, and finance affordable housing, green infrastructure, and community resilience so public dollars stay in our neighborhoods.

NORTH COAST

Debbie Notkin of Public Bank East Bay and Rick Girling of SF Public Bank led a California Public Banking Alliance teach-in with North Coast Progressive Alliance and The Next System Project at Cal Poly Humboldt. They presented an educational slide show on public banking basics and led engaging conversations with students and community members from Humboldt County and beyond on the transformative potential of public banking for California communities.

SAN FRANCISCO

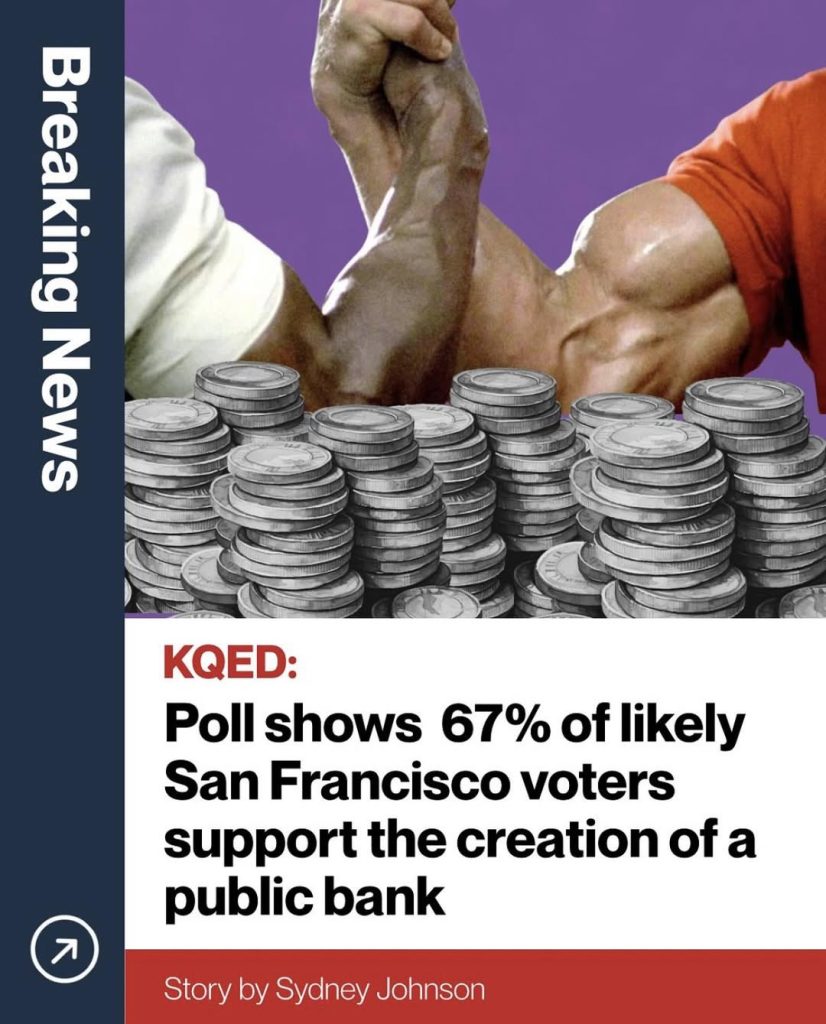

SF Supervisor Jackie Fielder and the SF Public Bank Coalition passed a resolution calling on the city treasurer to move forward to create a municipal green bank for San Francisco! It would start the process of figuring out how to establish what could become the country’s first municipal bank.

KQED: San Francisco Public Bank Supporters Eye 2026 Ballot Measure

48 Hills: New poll shows resounding support for public bank in San Francisco – 48 hills

Mission Local: S.F. has a plan for a public bank. One supervisor wants to act on it.

Public Banking in London

The public banking movement is going international. For our Coast to Coast webinar, Max Nichols, a fellow at the London School of Economics and a volunteer with the California Public Banking Alliance, organized a student watch party on campus. Public Bank London is on the horizon.