Event Wrap-Up – CalAccount Statewide Town Halls

CalAccount February 2024 Town Hall Report

Hundreds of CalAccount supporters took the time to passionately document the extreme hardships that working class Californians face due to the absence of affordable financial services. They arrived at three town halls convened in late February by the California Treasurer’s Office in Fresno, Oakland, and Los Angeles to gauge support for this innovative solution that will dramatically improve the lives of the unbanked and underbanked.

These town halls drew grassroots community leaders, business leaders, experts in financial services access, labor leaders, and workers. All testified to the overwhelming need for a no-fee, no minimum balance, no overdraft fee account overseen by the State of California.

Facilitated by the CalAccount Executive Director, Cassandra DiBenedetto, town hall participants provided powerful testimony supporting the need for the program. Public participation is required to be included in the final report by RAND, the firm conducting the CalAccount Market Study for the Treasurer’s Office.

Visit the California Public Banking Alliance YouTube page to view video clips from the town halls.

To watch the full video recordings of the CalAccount Town Halls, visit the CalAccount Blue Ribbon Commission page on the State Treasurer’s website.

FRESNO

.

The first town hall kicked off in Fresno, where numerous Central Valley leaders addressed issues such as access to banking services, banking deserts, and the high fees faced by Latino, African-American, and Native American constituents.

David Mendoza, Project Director, Fresno Native American and Business Development Center. “Native communities have the highest percent of being unbanked, between 16 and 22%! I wholeheartedly support CalAccount and hope to collaborate further to make this program a reality.”

Maria Maldonado, Statewide Director for California Fast Food Workers Union: “Most checking accounts require either a monthly fee or a minimum balance, or both. What do you think the average minimum balance is to avoid paying a fee? About $500, a little more than the $450 that is the average paycheck fast food workers earn in a week.“

Other leaders who spoke in Fresno:

Samuel Molina, CEO and Founder of The Academy of Financial Education;

Eric Payne, Executive Director of Central Valley Urban Institute;

Aliyah Shaheed, Bay Area Organizer of Rise Economy.

OAKLAND

In Oakland, community leaders, financial access experts, and workers voiced their support for CalAccount, emphasizing its viability and the urgent need for the program.

Theresa Rutherford, President, SEIU 1021, and member, Executive Board, SEIU International: “Our aim and our goal is to make sure all workers can access good benefits. CalAccount creates access and generational wealth. We know banking is important to any worker being able to move forward in their day-to-day lives. I have co-workers who are not able to do basic things like rent a car, stay at a hotel, or even buy gas.”

Dr. Nari Rhee, Director, Retirement Security, Berkeley Labor Center: “California has several examples of successful financial service programs where the state stepped in to meet a need that wasn’t being served by the market…

These programs deliver value to workers and consumers in three ways: First, they fulfill an unmet need that the private market either isn’t interested in serving or doesn’t serve very well. Second, they bundle together a large number of consumers, which means stronger bargaining power with financial institutions than we have as individual consumers. Third, they combine private administration with public oversight. All of this means a higher quality product at a lower cost.”

Varun Gupta, Chief Financial Officer, MoCaFi: “This is a great initiative. We have worked with San Diego, LA, and other communities to make financial products more accessible. The most critical factor for the financially vulnerable unbanked and underbanked is a lack of access. This could change the lives of people and bring them financial stability. Imagine the psychological benefit of not having to look over your shoulder because you are carrying cash. It’s an upside-down system where poor people are paying all the fees and people like me are getting all the benefits.

Wesley Alexander, CEO of CoBiz Richmond, a business incubator for students, small business owners, and new immigrants in Richmond California: “During COVID, hundreds of businesses closed because they did not have a bank account or financial history or a relationship with a bank. This is a very, very important endeavor for people to have access. Just because you are unbanked does not mean you are untalented or can’t be a good citizen in your community.”

Sylvia Chi, Senior Policy Analyst and Attorney, Just Solutions, SF Public Bank Coalition, California Public Banking Alliance: “Folks may have heard the federal government is proposing rules to limit overdraft fees. Banks are resisting the proposed rule, and are likely to litigate against it. In the past, when one type of fee is limited, they come up with a new type of fee. When Congress imposed limits on swipe fees on debit cards in 2010, banks increased monthly maintenance fees… In conclusion, Californians need what CalAccount offers, a fee-free way to access their money and a guarantee it will stay fee-free.”

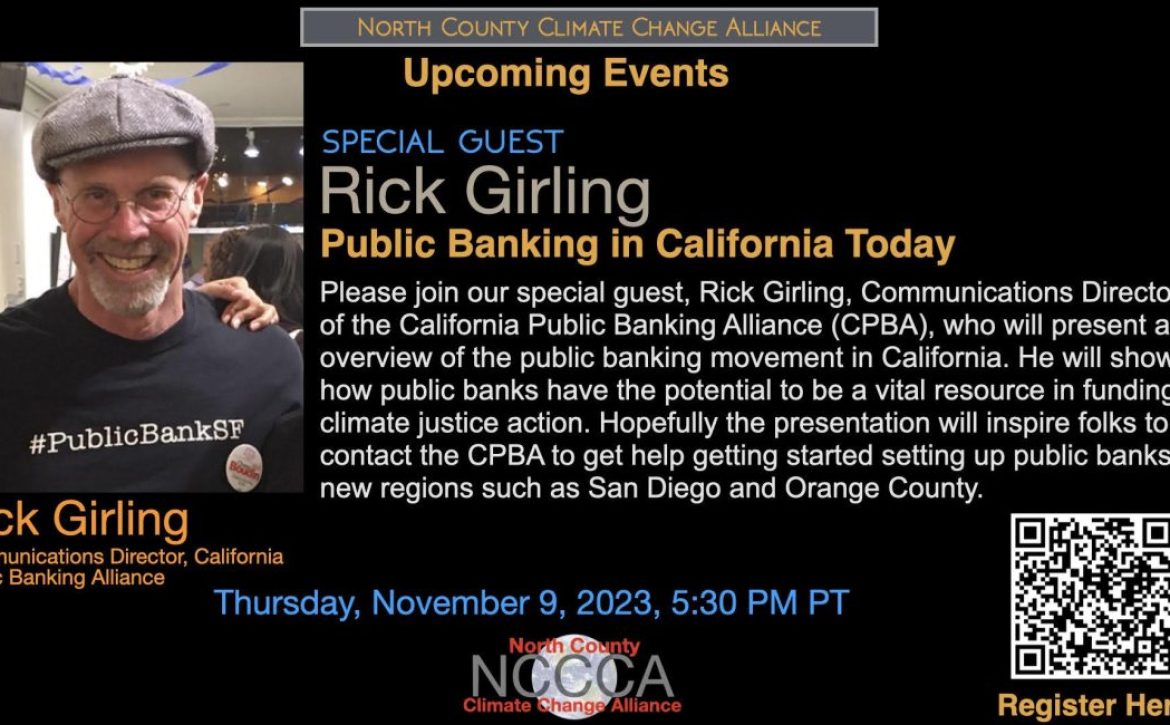

Rick Girling, retired public school teacher, SF Public Bank Coalition, Communications Director, California Public Banking Alliance: “I recently was charged a $35 overdraft fee. I had the money in my account and was pissed, but for those who live paycheck to paycheck, a $35 fee is devastating.”

Other speakers in Oakland included:

Emily DiVito, Deputy Director, Corporate Power, Roosevelt Institute;

Brandon Dawkins, VP of Organizing, SEIU 1021;

Jennifer Esteen, Board co-chair, Public Bank of East Bay;

Brandon Greene, Policy Director, Western Center on Law and Poverty;

Loraina Flores-Martinez, Associate Director of Partnerships, MyPath;

Noel Knowles, MyPath;

Stacy Pourfallah, Financial Specialist, International Rescue Committee.

Workers and Community members:

Guillermina Calvo, Josefina Ramos, Claudia Romero, Romualda Alcazar, Dulce Escalante, Guadalupe Sanchez, Julisa Villa, Dilia España, Samantha Alamo, Beatriz Avila, Massiel Picado

LOS ANGELES

The third and final town hall wrapped up in Los Angeles on February 23, where community leaders, labor leaders, immigrant advocates, anti-poverty organizers, academics, and workers spoke about their experiences with unfair banking practices. The speakers stressed the need for a state-run bank account free from charges or penalties.

David Green, President and Executive Director, SEIU 721: “As a social worker, LA County Child and Family Services, I met dozens if not hundreds of Californians who lack access to affordable financial services. The state can remove an unnecessary roadblock to communities that have borne the brunt of being excluded from the financial system. With CalAccount our state will emerge stronger and more inclusive than ever before.”

Toya Vick, peer Support Specialist and Organizer, Participatory Defense of the Inland Empire: “I am here representing the underserved communities of formerly incarcerated individuals, seniors, and children. This will help integration of formerly incarcerated individuals into society. They often lack traditional IDs needed to open a bank account or establish a line of credit. Banks don’t accept incarceration IDs. When they are able to open accounts they are hit with maintenance fees, overdraft fees, or other junk fees, causing them to have to close their accounts, miss paying bills, and further destabilize their lives.. When they have to go to an ATM outside their network, they have to pay fees of $3.50 up to $8.00 for each transaction.”

Elba Serrano, East LA Community Foundation: “We work with low-income immigrants, and they have a lot of stressful experiences with banks. They are charged fees or have accounts closed and be listed in Chex Systems, making it harder to open another account. I have been to the bank on payday and seen people waiting in line for hours to talk with the one banker who speaks Spanish, letting other people go in front of them. We work with street vendors, Mariachis, they operate in cash, they are vulnerable, they get robbed, and they lose out on business because they can’t accept Zelle.”

Andy Winnick, Professor of Economics and Statistics, CSU-Los Angeles (retired): “If people don’t have a bank account, they have a problem. They have to pay in cash or pay 8-10-12% of money for a check. They face safety issues and the time-mismatch of getting paid weekly, but paying bills monthly; how can they keep their money safe until they can pay bills? They also face problems with discrimination. We have many studies that show black, Latino, also single mothers who are discriminated against in the banking system. During COVID, we wanted to send benefit checks. Middle class, most white people got money deposited directly into their accounts. We tried to get checks to other people, but without bank accounts, they had no way to cash them without losing 8-12% off the top. 50,000 people in the LA area are unhoused, and very vulnerable to safety issues if they don’t have a bank account. CalAccount could help people save more money, could actually reduce homelessness.”

Trinity Tran, Co-Founder, Public Bank LA, California Public Banking Alliance: “When people are able to hold onto their money instead of spending it on expensive fees and interest charges—this boosts the economy. CalAccount would free up funds for low-income households to spend on goods and services, stimulating economic activity, and leading to job creation across various sectors. A 2021 study by HR&A Advisors pointed to exactly that. They found that by redirecting spending away from bank interest and fees, keeping hard-earned dollars in the pockets of Californians, the CalAccount program would serve 3.5 million individual workers in California resulting in $3.3 billion in savings for low-income households, creating 22,000 jobs and boosting the California economy by over $4 billion. Financial inclusion will add billions to strengthen California’s economy.”

Other leaders who spoke in Los Angeles included:

Luz Castro, Associate Director of Policy, Inclusive Action for the City;

Eunbi Kim, Community Bank Fraud Prevention Analyst;

Jay Miller, Lead, Inland SoCal BankOn Coalition;

Beverly Roberts, Co-Chair Home Defenders League, ACCE Los Angeles;

Javier Sarmiento, Co-chair Home Defenders League, ACCE Los Angeles;

Jasmine, Base Builder;

Doni Tadesse, Southern California Organizer, Rise Economy;

Julia Ornelas, Program Manager, Rise Economy;

Lovoy Mejia, Entrepreneur, Public Bank LA;

Erika Toriz-Kurkjian, Founder, Executive Director, Haven Neighborhood Services;

Emily Dibiny, Ground Game LA.

Workers and Community members:

Sabina Gutierrez, Jose Loubert; Yolanda Lopez; Angelica Hernandez; Felicitas Ortega; Marta Flores, Mysheka Ronquillo; Patricia Meza; Vicenta Diaz; Laura Salceda; Imelda Padilla; and

Manuela Saldana.