BREAKING! CalAccount Approved by California Legislature!

We’re excited to share that CalAccount is moving forward this year through the state budget process, and was included in the budget deal agreed to by the Governor, Senate, and Assembly, a strategic path forward made possible by the leadership of Assemblymember Avelino Valencia (D-Anaheim), Governor Newsom and his legislative staff, the Chiefs of Staff for Senate President pro Tempore McGuire and Budget Chair Wiener, Speaker Rivas, Assembly Budget Chair Gabriel, and State Treasurer Ma, along with her Chief Deputy Treasurer.

This year’s state budget provides $1 million toward implementation in the CalAccount Commission process. Once approved, CalAccount will become the nation’s first state-administered, fee-free public banking option. It builds on the groundwork laid by the California Public Banking Option Act (AB 1177), passed in 2021, and the CalAccount Blue Ribbon Commission, chaired by State Treasurer Fiona Ma, which produced the market analysis in 2024. This is another major step toward ending financial exclusion and reducing economic inequality across the state.

CalAccount will provide a safe and free public banking alternative for over 7 million unbanked and underbanked Californians, including 2.5 million households. Each year, California families lose $4.5 billion to financial fees. That’s money that should go toward rent, groceries, and bills, not bank profits. As costs rise, CalAccount provides real relief for low-wage workers and vulnerable communities, providing a practical alternative to the predatory fees and penalties of big banks.

Thank you to everyone who sent emails and letters to the Governor and budget leaders. Your support helped make this happen!

Why it matters:

- CalAccount could save underbanked households upwards of $1,000 per year.

- It’s projected to deliver over $45 million in economic stimulus in its first year alone.

- The program is designed to be cost-neutral over time, funded by user swipe fees, not taxpayer dollars.

CalAccount is an urgently needed path forward to keep more money in people’s pockets and ensure every Californian has access to basic financial services, especially as consumer financial protections are being dismantled at the federal level.

We’re proud to help lead this effort with SEIU California and the CalAccount Community Coalition, and to see California once again set the national standard for economic justice.

Read our press release here.

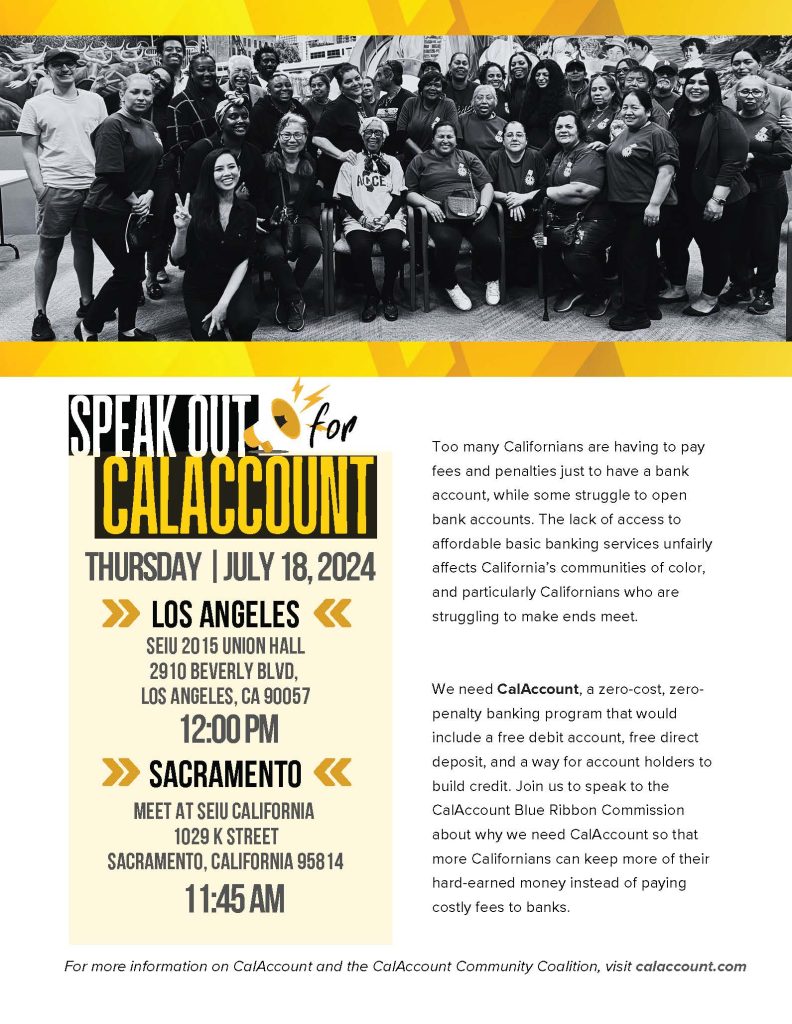

CalAccount Community Coalition in Sacramento!

Photos from our CalAccount Advocacy Day and training session with the CalAccount Community Coalition and California Fast Food Workers at the State Capitol and SEIU State Council in Sacramento.

CalAccount Community Coalition gathers at the Capitol Rotunda.

CalAccount Community Coalition and California Fast Food Workers Union with Assemblymember Avelino Valencia.

Sylvia Chi – California Public Banking Alliance (CPBA), Cynthia Amezcua – FreeFrom, Trinity Tran – CPBA, Rick Girling – CPBA, Anneisha Williams – California Fast Food Workers Union (CFWU), Erika Connor – CFWU at the Capitol.

heila Ainsworth with California Fast Food Workers Union – CFWU, Michael Jones – CFWU, Trinity Tran – California Public Banking Alliance, Lilian Hernandez – CFWU, Pedro Loera – CFWU, Erika Conner – CFWU, Lio Sanchez – CFWU meeting with State Legislators.

Sylvia Chi – CPBA, Michael Jones – CFWU, Erika Conner – CFWU, Sheila Ainsworth – CFWU, Pedro Loera – CFWU heading to legislative meetings.

CalAccount Advocacy Training Session with California Fast Food Workers Union at SEIU State Council.

Sarah Zimmerman, Cecille Isidro – SEIU at the CalAccount Advocacy Training.