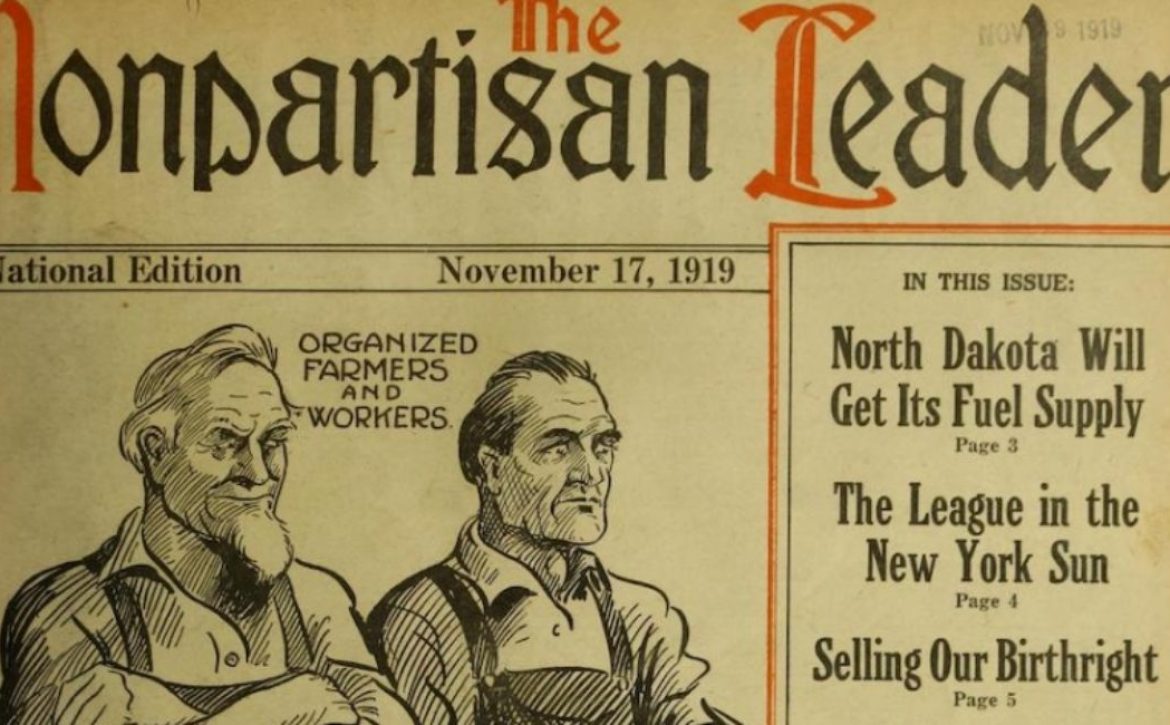

100 Years Ago, Farmers and Socialists Established the Country’s First Modern Public Bank

In These Times authors Thomas M. Hanna and Adam Simpson gives the California Public Banking Alliance a nod! “Whatever the bill’s ultimate fate, the campaign that the California Public Banking Alliance has put together is truly remarkable. More than 100 organizations representing 3.3 million Californians have endorsed the bill. These include labor unions (such as the California Nurses Association, SEIU California, AFSCME California and UFCW Western States Council), community groups (such as People Organizing To Demand Environmental and Economic Rights and Healthcare for All- California), environmental groups (such as 350.org, Friends of the Earth and the Local Clean Energy Alliance) and political organizations (such as the California Democratic Party and the Green Party of California). Moreover, 10 city governments have backed the effort, including Los Angeles, San Francisco, Oakland, and San Diego.”

Continue reading on In These Times.